This guide provides a step-by-step process for importing the Amazon settlement report in Tally.

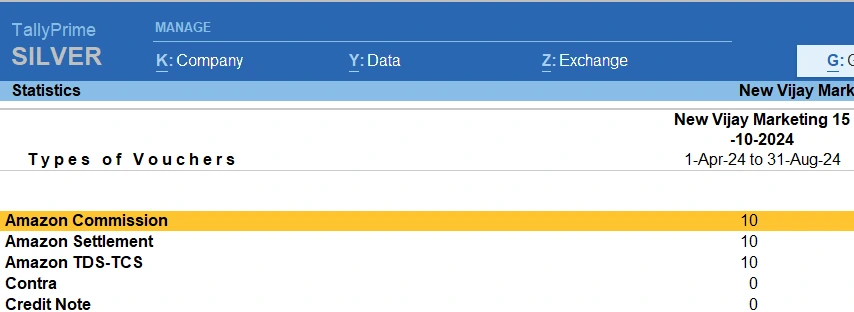

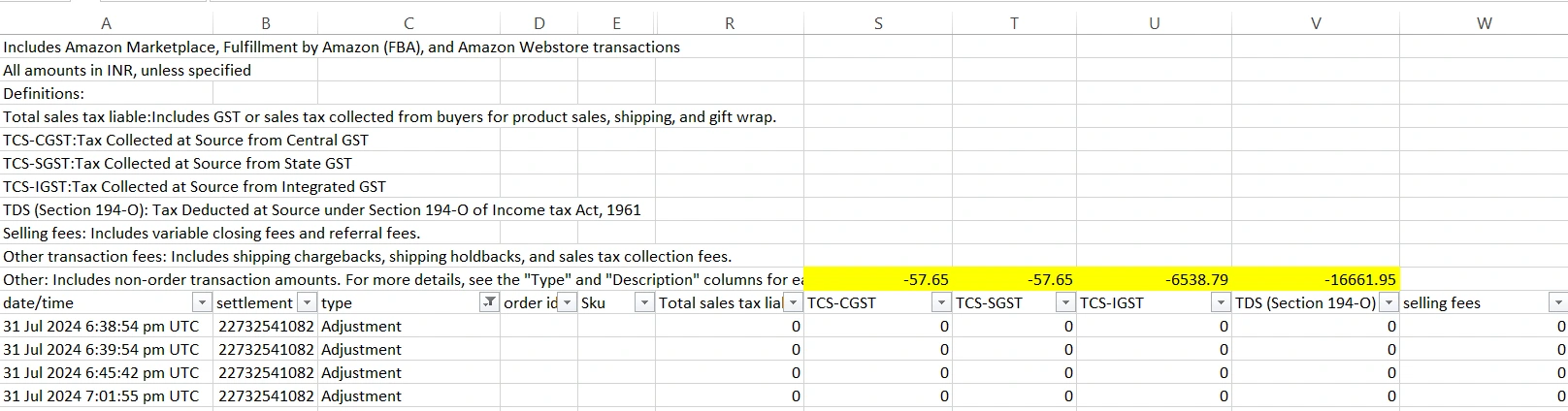

1. Amazon settlement report can be segregated majorly in following 3 categories

Amazon selling fees, shipping fees, commission etc.

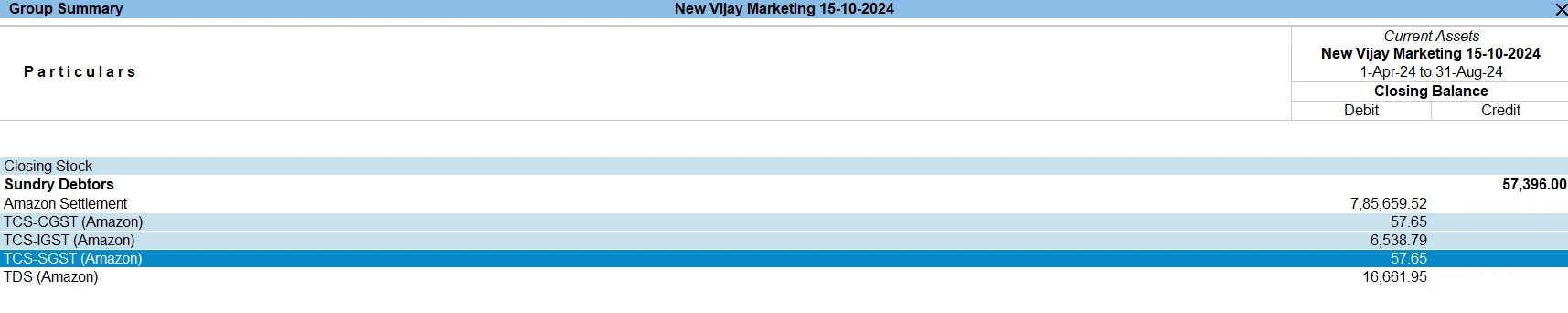

TDS-TCS deducted by amazon

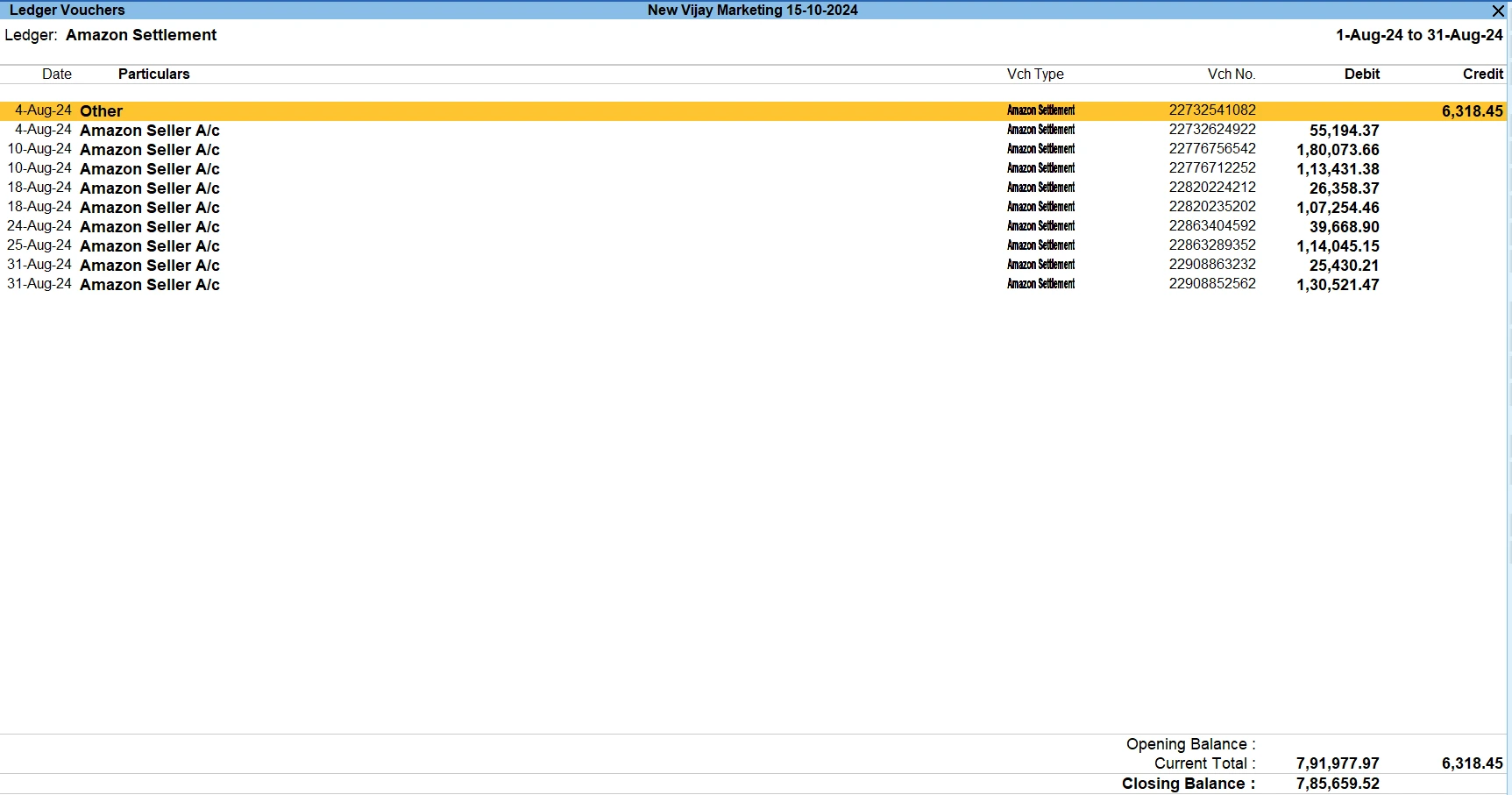

Settlement made by amazon towards orders

2. Follow these steps to easily and quickly upload your Amazon report:

Log in to Your Account: If you’re a new user, sign up at Tally Integration. Existing users can log in directly.

Upload Settlement Report

In the left side pane, go to Upload Reports.

Select your company, then Market Place, choose the year & month, and upload your settlement report.

Download the TDL file and load in Tally.

On the Gateway of Tally, go to https://tally-integration.in/ and enter your login credentials in Login.

Go to View & Import and choose the relevant options and entire data will be displayed on the Tally screen.

Click on import buttons in the following order:

Import New Ledgers

Import Vouchers