With https://tally-integration.in, you can effortlessly upload your Amazon sales and returns data into Tally. Our platform supports both Amazon MTR B2B and B2C files, making the process smooth and efficient. See the detailed procedure and start streamlining your accounting tasks today.

Step-by-step guide to Import Amazon MTR Sales Report

Upload the Report on tally-integration.in

Sign up at Tally Integration, and existing users may log in here.

After logging in, click on Company List and add your company (if already added, this step is not required).

New users need to activate the trial from the left-side menu.

Go to Import Settings, choose Company and E-Commerce Platform, and map necessary ledgers and voucher types.

Note: Default voucher types and ledgers will be auto-populated. You can modify them if needed.

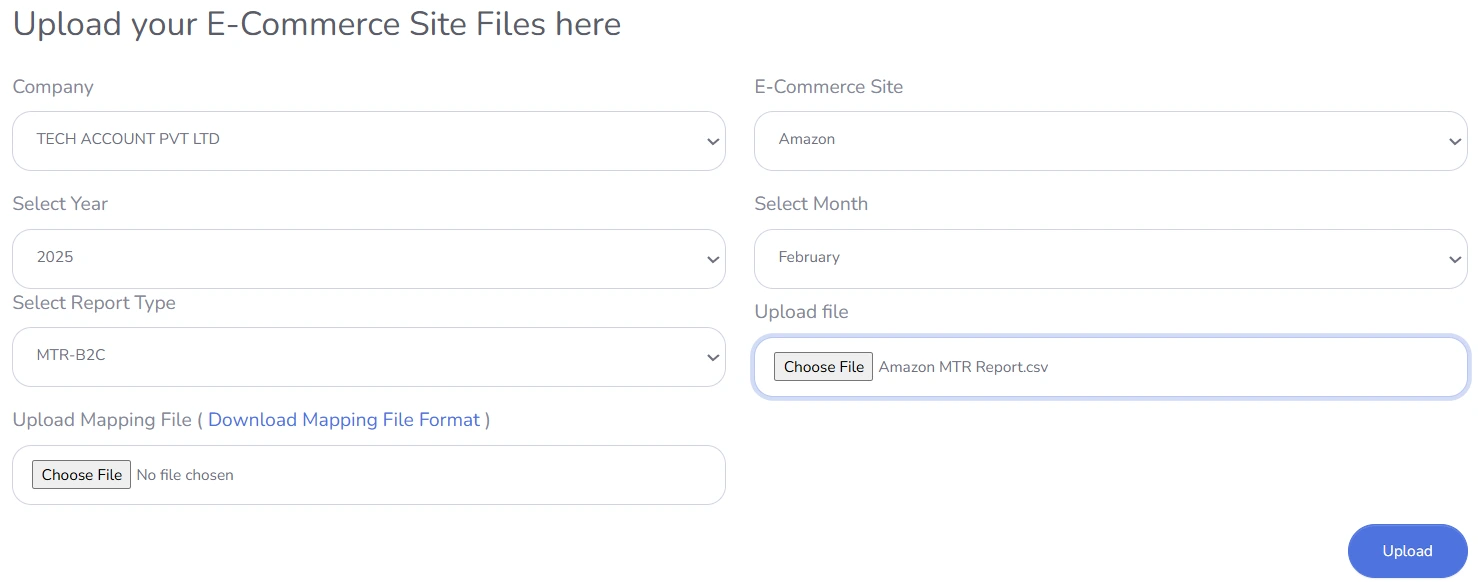

Go to Upload Reports from the left-side pane, choose Company, Marketplace, Year & Month, then upload the following reports:

Amazon MTR-B2B Report

Amazon MTR-B2C Report

Load TDL and Import Data in Tally

Download TDL from here.

Open Tally / Tally ERP Prime and load the TDL.

Open an existing company or create a new company.

Update PAN and GSTIN in Tally. To learn the procedure, click here.

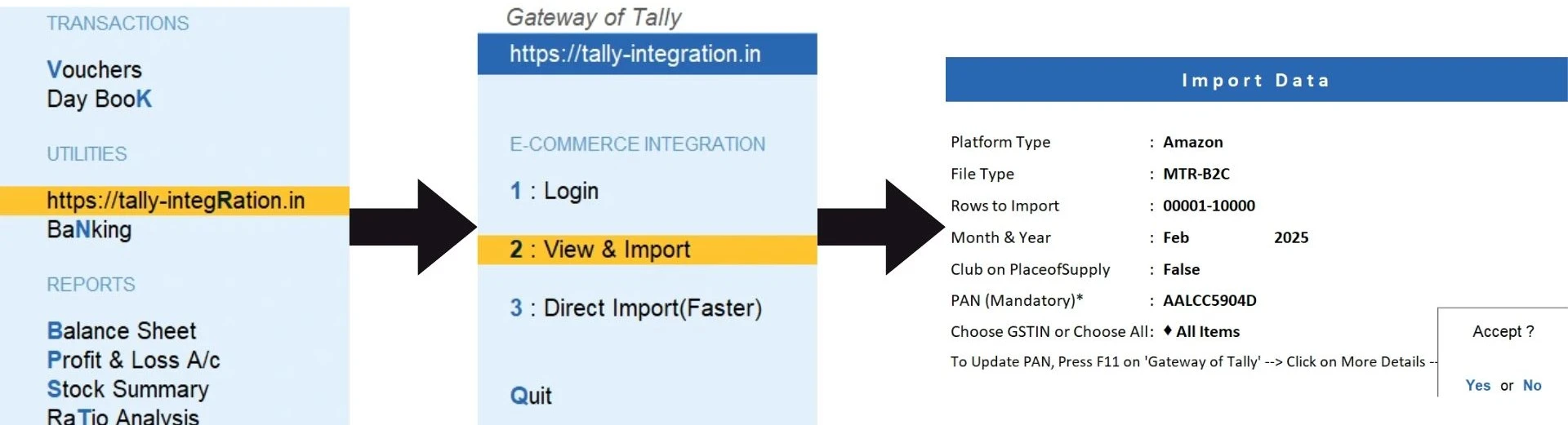

On the Gateway of Tally, go to Tally Integration and enter the login credentials of https://tally-integration.in/

Go to “View & Import”, choose the relevant options, and proceed.

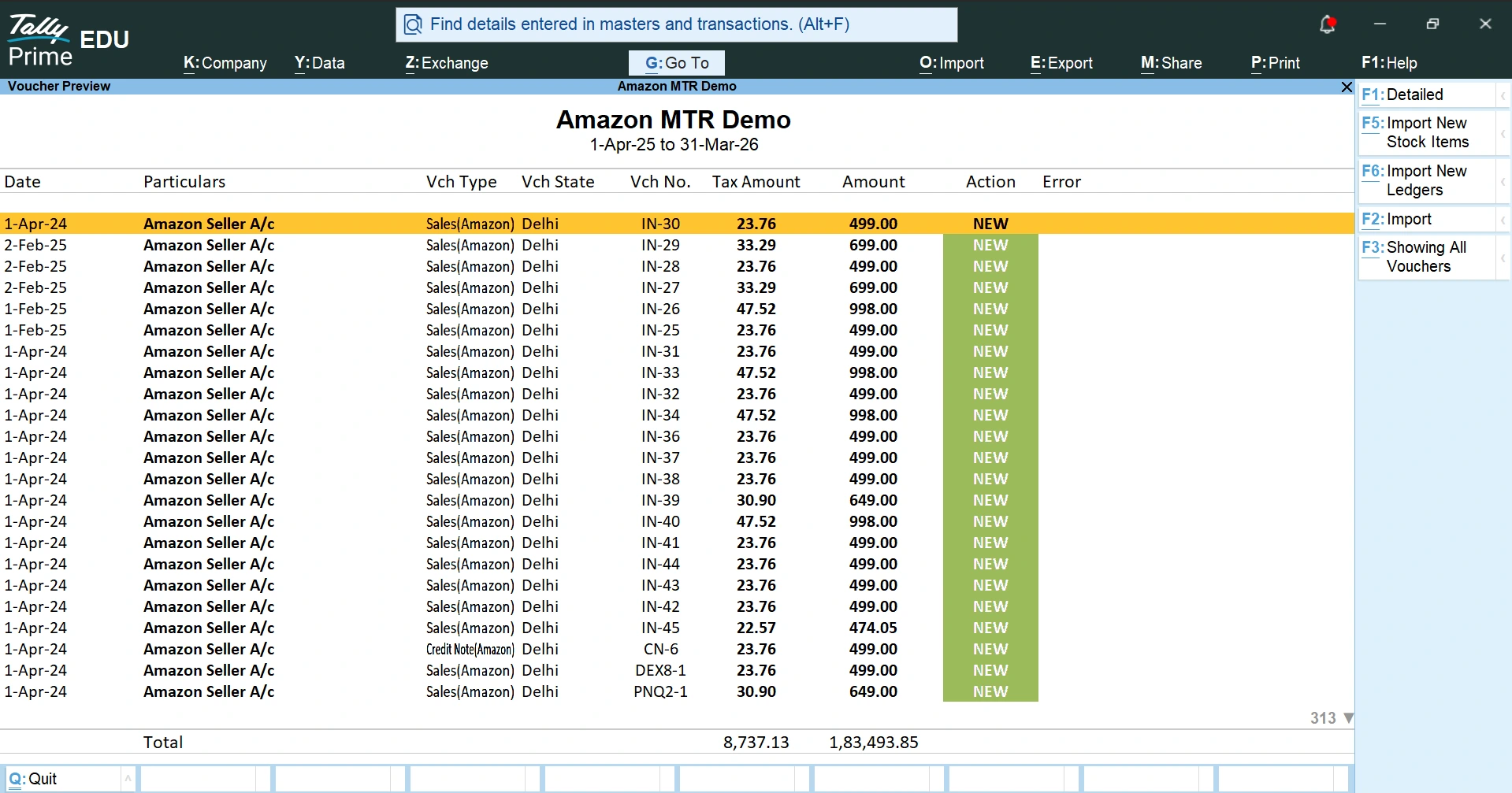

The entire data will be displayed on the Tally screen as shown below:

Now, click on the import buttons in the following sequence:

i) Import new stock items to create new items if any

ii) Import new ledgers to create new ledgers if any

iii) Import vouchers to create vouchers

Reconciliation of data in Tally and Amazon MTR Sales Report

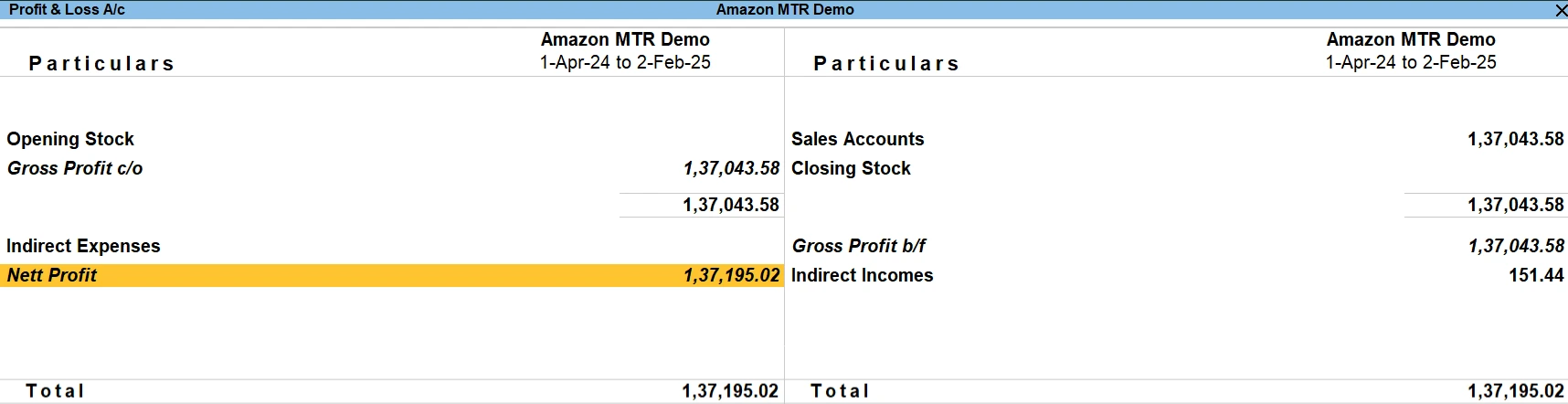

Reconciliation with Profit and Loss account

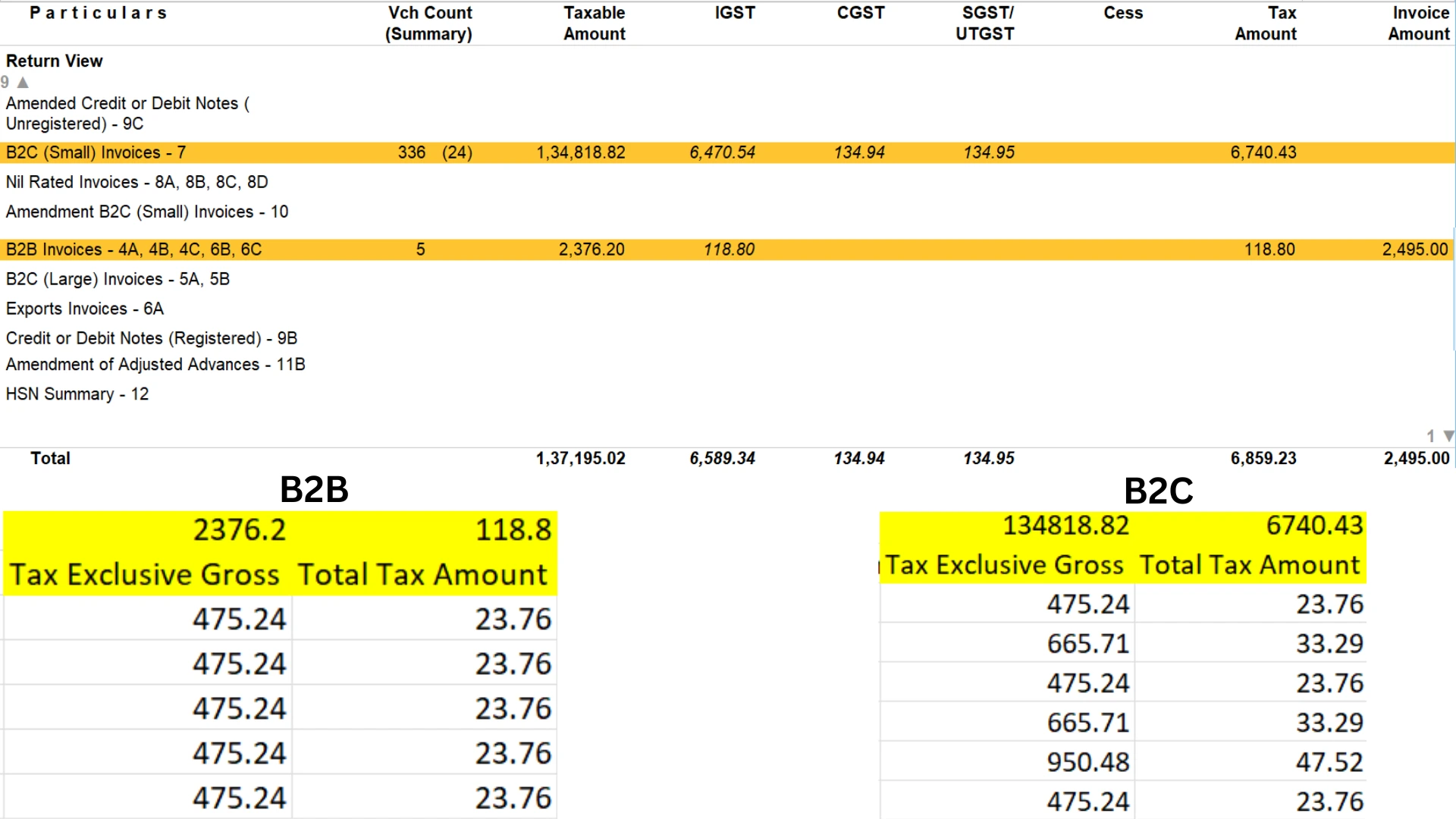

Open the profit & loss a/c in Tally and note the total amount of sales (e.g., Rs. 137,195.02 in the figure).

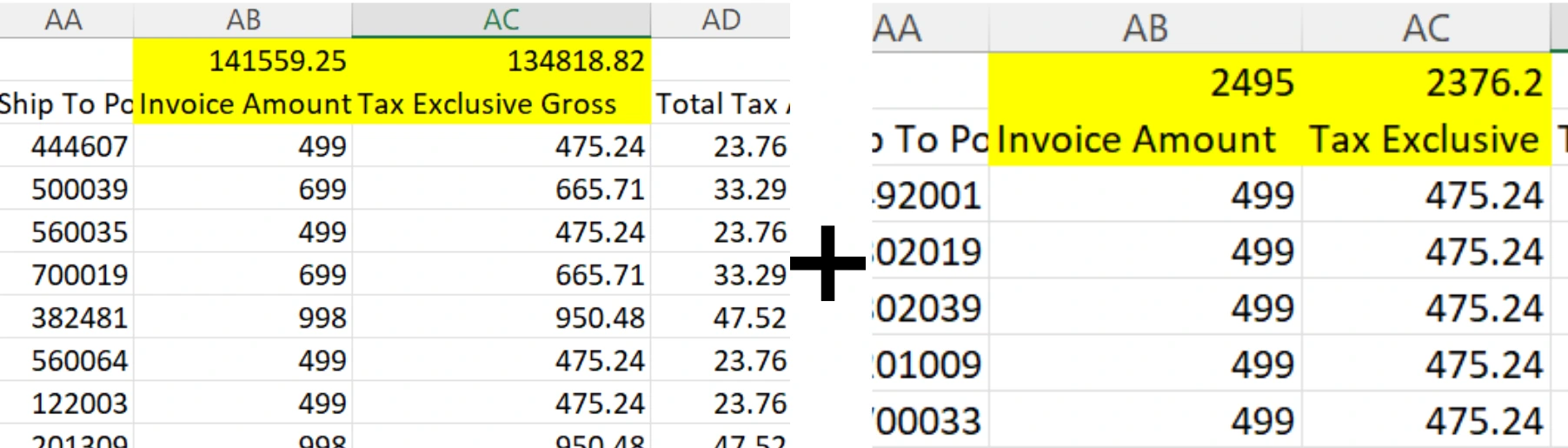

Open the Amazon sales report (both the B2B and B2C reports) and apply the sum formula in column AC (e.g., Rs. 134,818.82 + 2376.2 = 137,195.02; refer to figure).

Reconciliation with GSTR-1 Report

Now reconcile GSTR-1 Taxable Value and Tax Amount with the total of the ‘Tax Exclusive Gross’ and ‘Total Tax Amount’ columns in the Amazon MTR Sales Excel file.

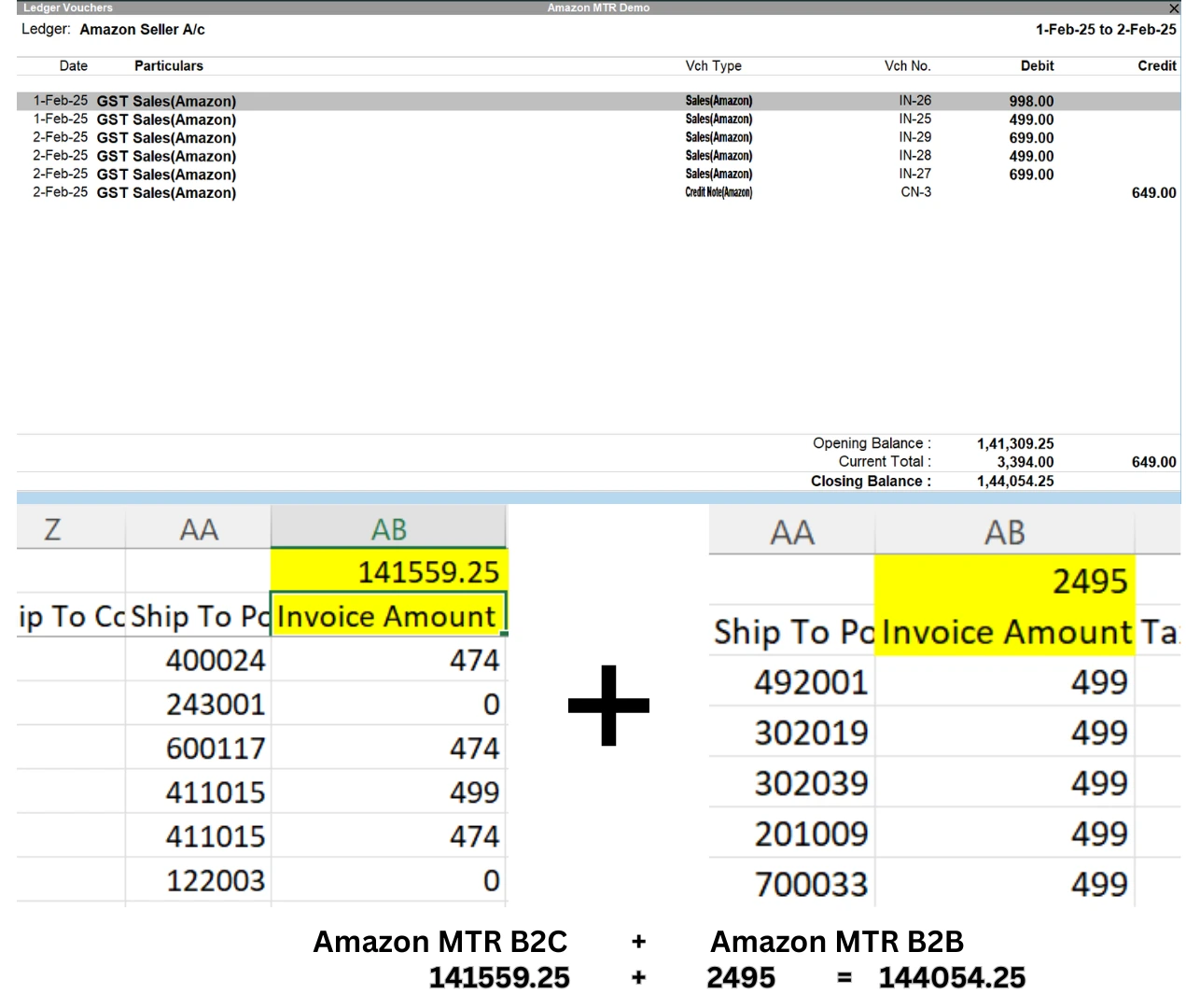

Reconciliation with Amazon Seller Ledger

Open the Amazon Seller Ledger in Tally. Calculate the difference between Total Debit and Total Credit as shown in the image below.

Verify the same with the total of the ‘Invoice Amount’ column of the Amazon MTR Sales Report.