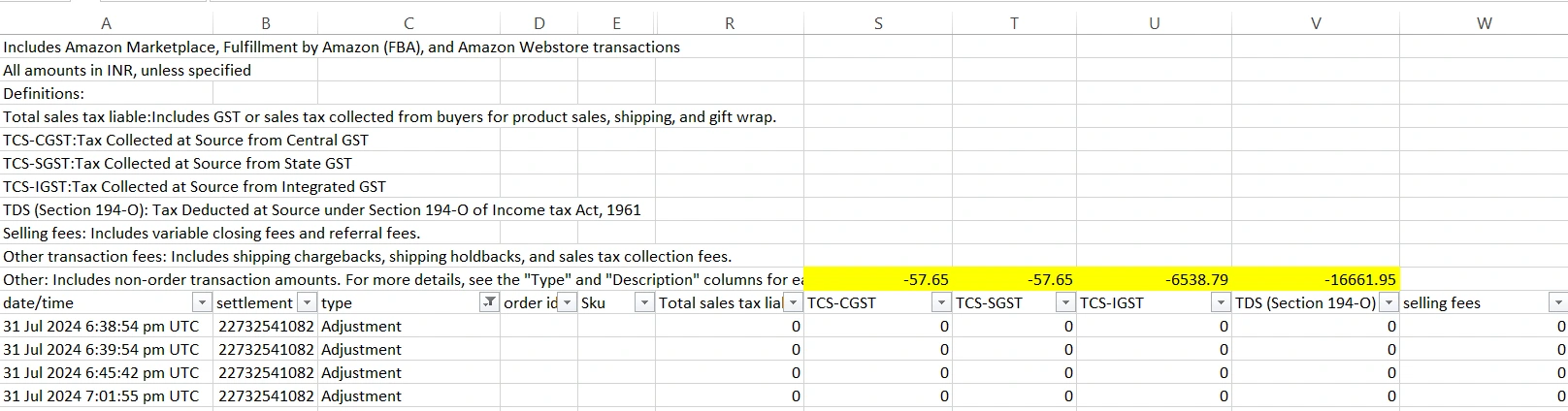

Amazon settlement report includes commission, shipping and other charges deducted by amazon. It also includes TDS, TCS deducted by amazon. This guide provides a step-by-step process for importing the Amazon settlement report in Tally.

Sign in and upload Amazon Settlement Report

Sign up at Tally Integration, existing users may login here.

Go to Upload Reports from the left side pane, choose company > Market Place > Year & month and upload your settlement report.

In the left side pane, go to Upload Reports. (See procedure to download reports)

Load TDL and Import Data in Tally

Load TDL in Tally.

On the “Gateway of Tally” screen, go to Tally Integration.

Under the login option, enter your login credentials for Tally Integration.

Go to View & Import, choose the relevant options, and proceed.

Once the data is displayed on the Tally screen, click on the import buttons in the following sequence:

Import new ledgers

Import vouchers

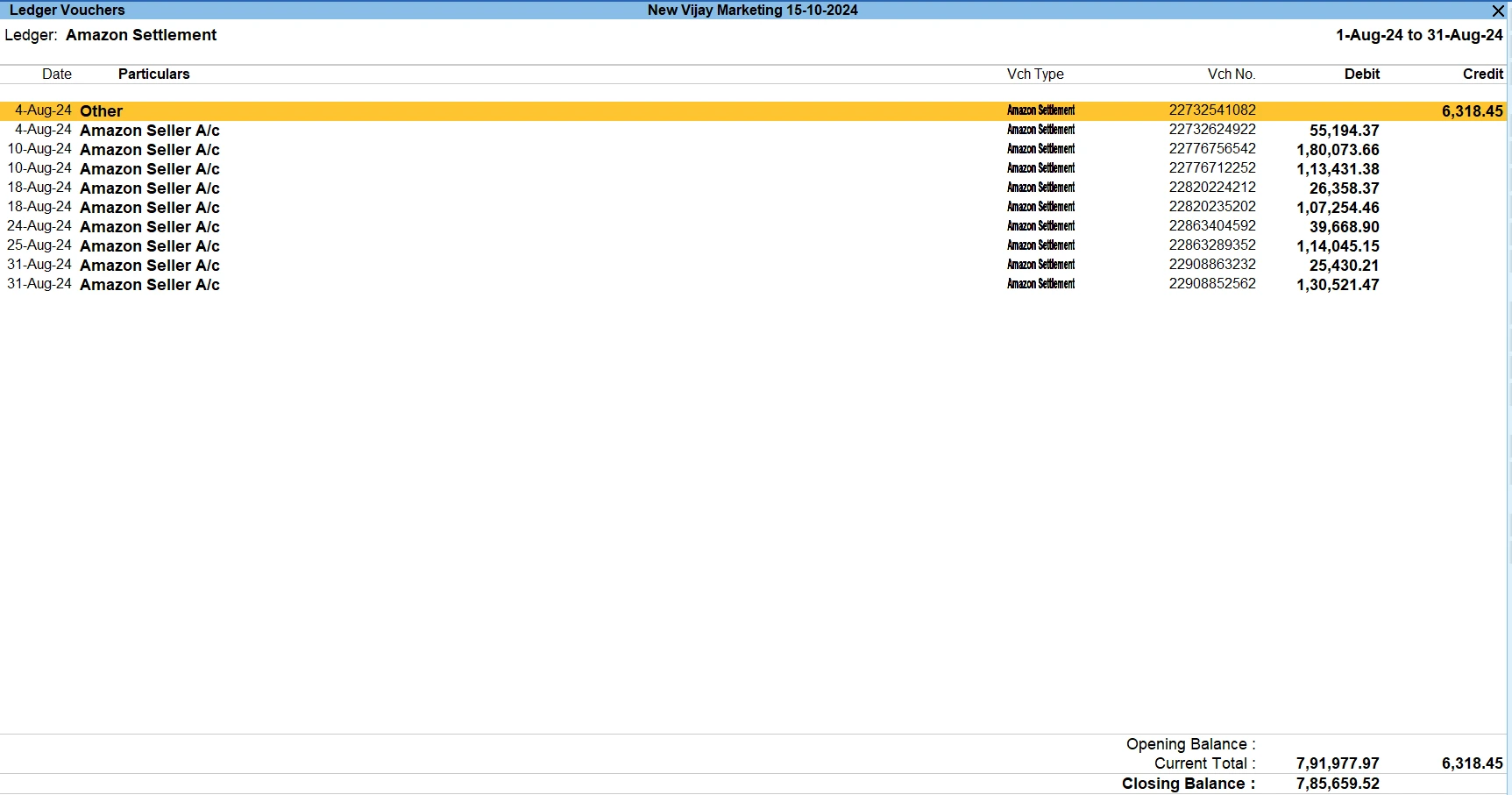

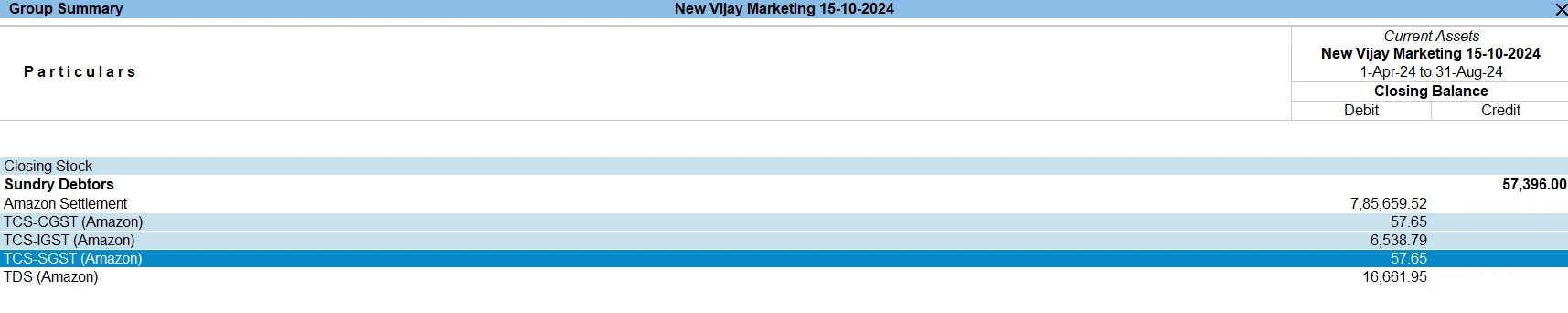

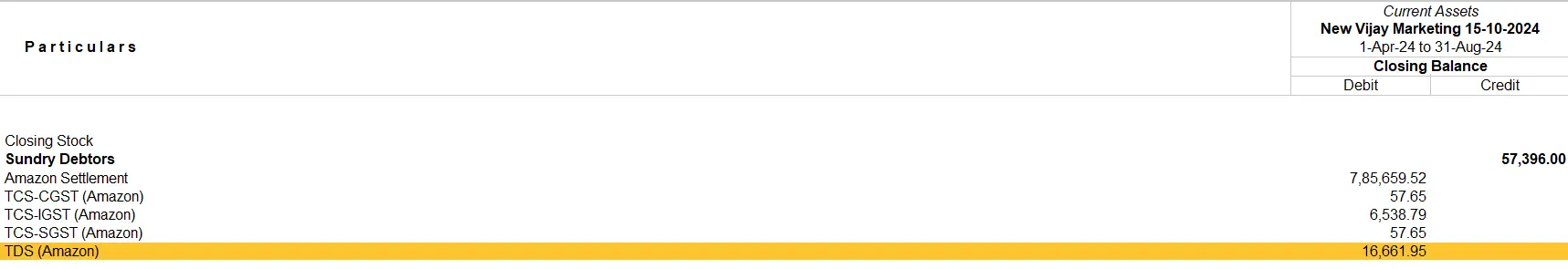

Reconcile Settlement Report in Tally

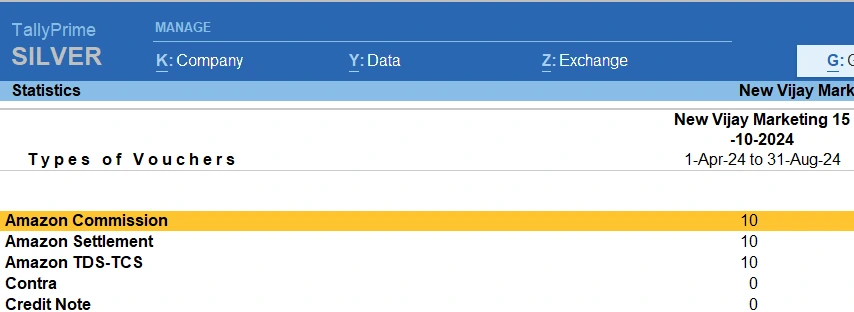

After importing the vouchers into Tally, you will see three voucher types:

Amazon Commission

Amazon Settlement

Amazon TDS-TCS